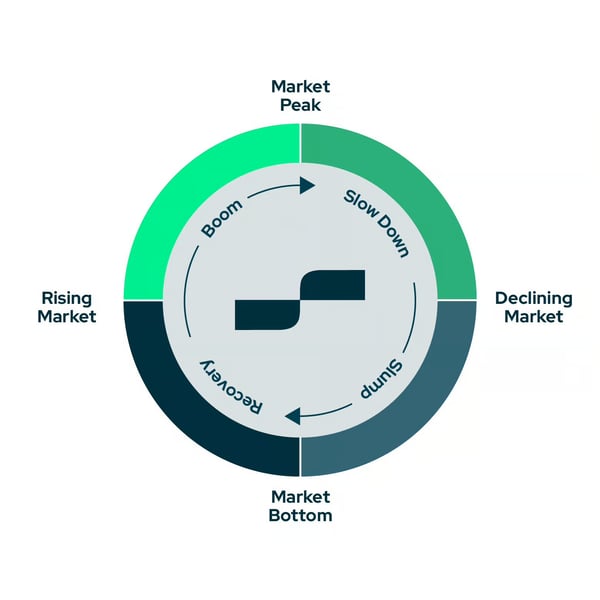

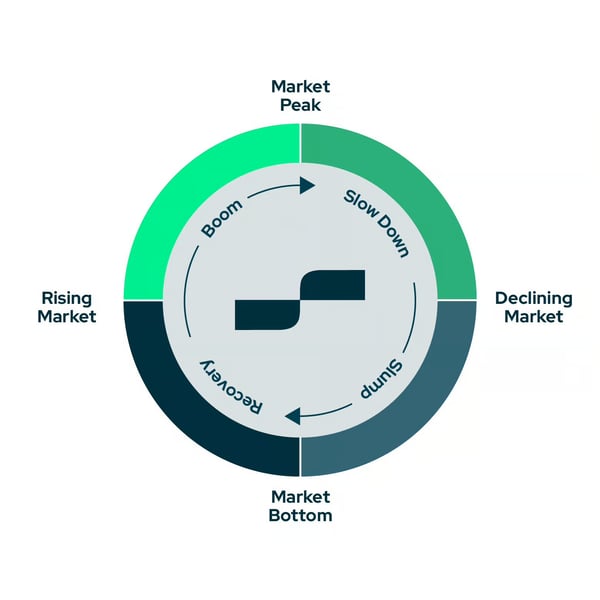

Welcome to our guide on understanding the property cycle in New Zealand! The property market in New Zealand, like many other countries, operates in cycles, characterised by phases of Recovery, Boom, Slowdown, and Slump.

During the Recovery phase, the property market experiences robust growth driven by factors such as strong economic fundamentals, population growth, low-interest rates, and high consumer confidence. Property prices tend to rise steadily during this phase as demand outpaces supply. Investors often witness significant capital gains, making it an opportune time to buy and hold properties for long-term appreciation.

The Boom phase marks the zenith of the property cycle, where prices reach their highest point. Demand remains strong, but signs of overheating may emerge, such as speculative buying, excessive leverage, and inflated property prices relative to fundamentals. Investors need to exercise caution during this phase, as the market may be vulnerable to corrections or downturns.

The Slowdown phase sees demand beginning to wane, leading to a slowdown in price growth or even modest declines. Factors such as rising interest rates, economic uncertainty, and regulatory changes can contribute to a cooling market. Sellers may encounter longer listing times, while buyers may gain bargaining power as competition eases.

Finally, the Slump phase represents the bottom of the property cycle, characterized by stagnant or declining prices and subdued market activity. Economic challenges, such as high interest rates, recessions or job losses, may exacerbate the downturn. However, savvy investors view the Slump phase as an opportunity to acquire properties at discounted prices, positioning themselves for future capital appreciation when the market rebounds.

Factors Influencing the Property Cycle:

Several factors influence the property cycle in New Zealand, including economic conditions, population growth, employment rates, interest rates, government policies, and market sentiment. Economic prosperity, low unemployment, and strong population growth typically drive demand for property, pushing prices higher during the expansion phase. Conversely, economic downturns, high unemployment, and restrictive government policies can dampen demand and lead to price declines during the contraction phase.

Regional Variations: It's essential to recognize that the property cycle can vary significantly across different regions of New Zealand. While major urban centres like Auckland may experience more pronounced cycles due to higher demand and supply pressures, smaller regional markets may exhibit more stable or subdued cycles. Investors should consider regional factors such as population growth, employment opportunities, and infrastructure development when assessing the property cycle in specific areas.

Investment Strategies: Successful property investors leverage their understanding of the property cycle to inform their investment strategies. During the Recovery phase, investors may focus on acquiring properties with strong capital growth potential, aiming to capitalize on rising prices. In contrast, the Slump phase presents opportunities for value investors to purchase properties at discounted prices. Adopting a long-term perspective and diversifying across different phases of the property cycle can help investors mitigate risk and maximize returns.

Strategies for Navigating the Property Cycle Include:

Timing is Key: While it's challenging to predict the exact timing of market peaks and troughs, purchasers can use indicators such as sales volumes, median prices, and rental yields to gauge the health of the market and identify potential opportunities.

Diverse Investment Options: Spreading investments across different property types and regions to mitigate risk, there's something for everyone’s taste in the dynamic landscape of New Zealand real estate.

Long-Term Perspective: Adopting a patient approach and focusing on long-term wealth accumulation rather than short-term gains.

Stability Amidst Change: Despite the inevitable fluctuations of the property market, New Zealand boasts a resilient and stable real estate sector that has weathered economic storms and emerged stronger than ever.

Although it’s great to learn and understand the cyclical nature of the property market, it’s also important to remember one of the oldest adages in real estate…. It’s not timing the market it’s “time in the market”. Trying to time your purchasing and selling of real estate to exactly align with the best time to do so, from a property cycle perspective is almost impossible. If you buy real estate and hold it for as long as you can, then you have the best chance of your investment increasing in value.